Sign up before Sept. 1st and SAVE $1,300 + FREE access to IRS-compliant software and hands-on mentorship for a year!

How to Start a Profitable Tax Preparation Business From Home

The 5-Day Tax Professionals Shortcut to Financial Freedom Course

Free IRS Compliant Tax Software

On-Going Mentorship

Earn A Yearly Salary in 120 Days this Tax Season

Why Do I Need This Course?

Let’s face it, you want to grow your business and your income, the easiest way to do that is by learning from someone who's been here before. The good news is that creating a profitable tax preparation business (or side gig) has never been faster or easier than it is right now with my Virtual 5-Day Tax Professionals Shortcut to Financial Freedom Course.

Let me show you how it works . . .

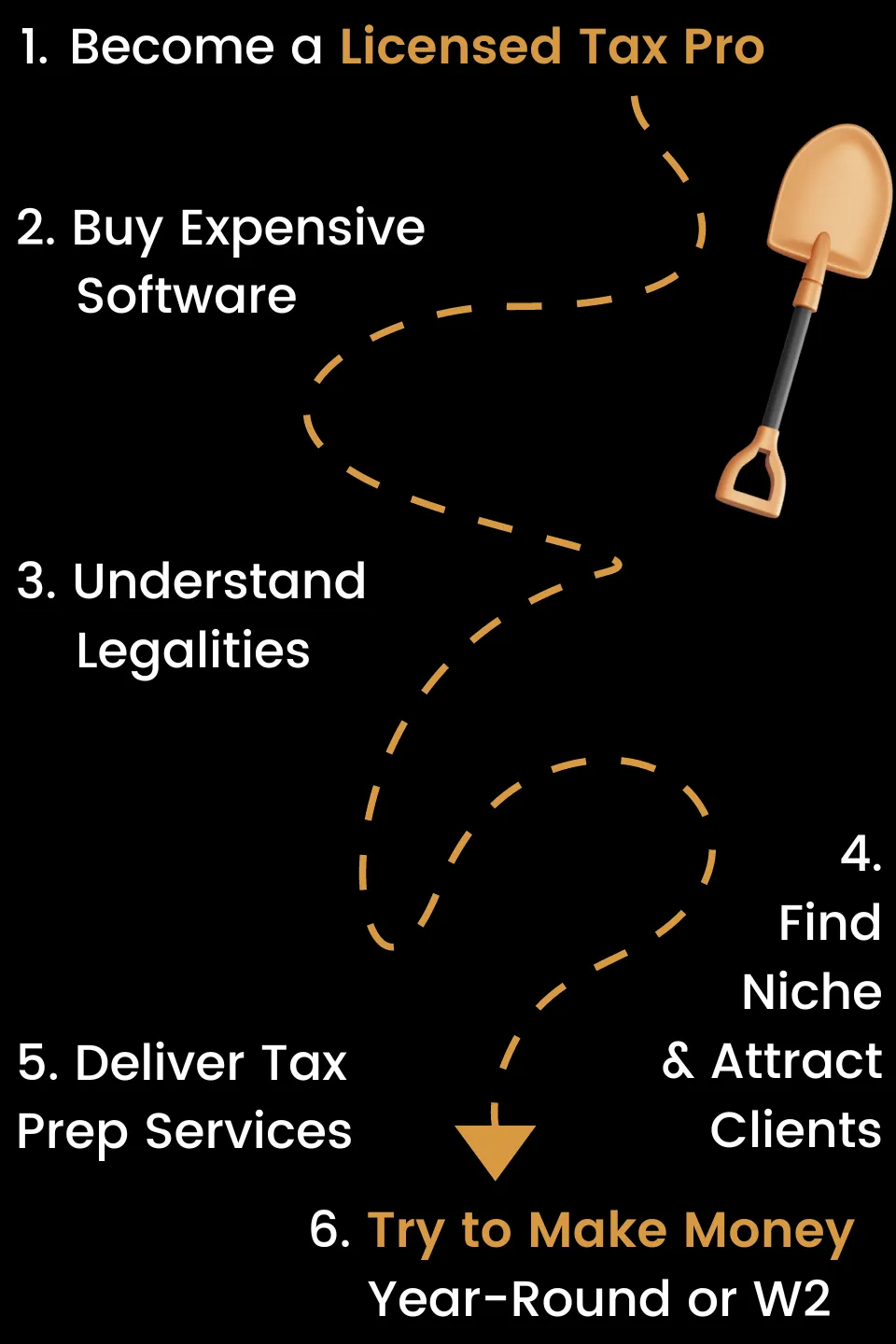

THE OLD WAY

THE NEW SIMPLE WAY

Most Tax Preparers Don't Make It On Their Own . . .

Getting started is EXPENSIVE

Tax software is costly, subscriptions range from $1,500 to over $20,000 per year. That's why you get my tax-compliant software included in this course.

The legalities are OVERWHELMING

Staying up-to-date doesn't have to be stressful. As your tax partner, I'll keep you updated on the information you and your clients need.

Finding new clients seems IMPOSSIBLE

My students average 30 new clients their first season. Learn how my marketing strategies can help you stand out, attract clients, and build your brand.

Tax season is short and UNSUSTAINABLE

Unless you want to scale your business and have employees, you should never have to ask, "How do I make money outside of tax season?"

My 5-Day Course Gives You Everything You Need To Start Your Tax Prep Services From Home and Make a 365-Day Salary in 120-Days . . .

PLUS, it's timed perfectly for this upcoming tax season!

Tax Knowledge and Skills

Fundamentals of individual, married, self-employment, and 1099 tax returns

Determining eligibility for dependents and Head of Household status

Differentiating services from competitors

Marketing and client acquisition strategies

Document collection and signature processes

Branded document templates

Profitability and pricing strategies

Business formation options (S-corp, B-corp, LLC) with pros and cons

Business Development

Access to a community of tax professionals

Free monthly training sessions

Partnership and mentorship program

Strategies for entering the Airbnb industry

Tax implications of first-time home buying

Empowering students to become independent entrepreneurs and refer new members

Software and Tools

Access to a customized IRS-compliant tax

software ($10,000 Value)

Software training and setup

Tax Knowledge and Skills

Fundamentals of individual, married, self-employment, and 1099 tax returns

Determining eligibility for dependents and Head of Household status

Differentiating services from competitors

Marketing and client acquisition strategies

Document collection and signature processes

Branded document templates

Profitability and pricing strategies

Business formation options (S-corp, B-corp, LLC) with pros and cons

Business Development

Access to a community of tax professionals

Free monthly training sessions

Partnership and mentorship program

Strategies for entering the Airbnb industry

Tax implications of first-time home buying

Empowering students to become independent entrepreneurs and refer new members

Software and Tools

Access to a customized IRS-compliant tax

software ($10,000 Value)

Software training and setup

Why This Opportunity?

Hi, I'm Lisbeth Recio . . .

I've walked in your shoes. Juggling a family, a career, and a side hustle or two . . . is no easy feat. I remember how overwhelming it was starting my own tax business. The endless hours of learning, the fear of making mistakes, the frustration of not knowing where to begin. It felt impossible. But I persisted because I saw the potential for financial freedom and flexibility it offered. Plus, how valuable it is to know how to do taxes for my other businesses. It’s a path that changed my life, and I want to make it easier for others.

What My Students Are Saying . . .

"Working with Lisbeth has absolutely been a delight. My knowledge and experience as a tax professional has expanded because of her. She’s always so willing to share her knowledge with others and make sure you actually understand what you’re learning. I can always count on Lisbeth to answer any questions or concerns I may have. I have never hesitated to ask her anything as she always replies with so much desire to help and provide ease."

— Ana T. joined in 2023

What My Students Are Saying . . .

"Working with Lisbeth has absolutely been a delight. My knowledge and experience as a tax professional has expanded because of her. She’s always so willing to share her knowledge with others and make sure you actually understand what you’re learning. I can always count on Lisbeth to answer any questions or concerns I may have. I have never hesitated to ask her anything as she always replies with so much desire to help and provide ease."

— Ana T. joined in 2023

Why This Opportunity?

Hi, I'm Lisbeth Recio . . .

I've walked in your shoes. Juggling a family, a career, and a side hustle or two . . . is no easy feat. I remember how overwhelming it was starting my own tax business. The endless hours of learning, the fear of making mistakes, the frustration of not knowing where to begin. It felt impossible. But I persisted because I saw the potential for financial freedom and flexibility it offered. Plus, how valuable it is to know how to do taxes for my other businesses. It’s a path that changed my life, and I want to make it easier for others.

So How Do I Sign Up?

Join the any of our 5 day LIVE Zoom classes and shortcut your way to financial freedom

I'm committed to making this accessible for you!

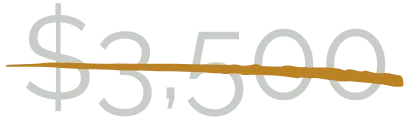

$2,200

Limited Time Only

Early-Bird Special

Hands-On Learning

Start your tax prep

business in 5 Days

Free Access to Tax Software

Year of Mentorship

Join from ANYWHERE!

We’ll meet via Zoom

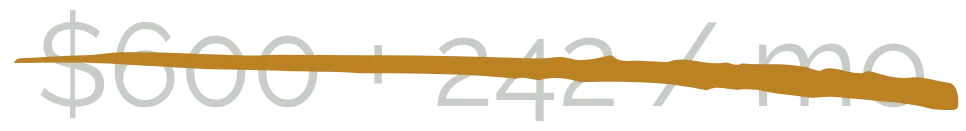

$600

+ 159 / mo. for 12 months

Early-Bird Special

Hands-On Learning

Start your tax prep business in 5 Days

Free Access to Tax Software

Year of Mentorship

Join from ANYWHERE!

We’ll meet via Zoom

Frequently Asked Questions

What States Is Your License Valid In?

Your IRS PTIN License is valid for All 50 States. In addition for filing for NY State taxpayers, an additional NYPTIN is required for this state.

Do I Need to Renew my License?

Yes, every year you must renew your PTIN and take at least 20 hours minimum of Federal and NY online courses to renew your license.

Are The Fees Tax Deductible?

All company fees and costs for the course is completely tax deductible and can be written off as business expenses.