Sign up before Sept. 1st and SAVE $1,300 + FREE access to IRS-compliant software and hands-on mentorship for a year!

Sign up before Sept. 1st and SAVE $1,300 + FREE access to IRS-compliant software and hands-on mentorship for a year!

Choose From 3 Course Sessions

With 3 flexible weekend options, you’ll gain the tools, mentorship, and support you need to launch your tax prep career in just 5 days. Pick the session that works best for you!

Let's launch your tax prep business in 5 days

Session 1

Fri. Sept, 6th

Sat. Sept. 7th

Sun. Sept. 8th

Fri. Sept. 13th

Sat. Sept. 14th

From 10 am - 6 pm EST

Session 2

Fri. Sept, 27th

Sat. Sept. 28th

Sun. Sept. 29th

Fri. Oct. 5th

Sat. Oct. 6th

From 10 am - 6 pm EST

Session 3

Fri. Oct. 18th

Sat. Oct. 19th

Sun. Oct. 20th

Fri. Oct. 26th

Sat. Oct. 27th

From 10 am - 6 pm EST

Course Overview

Day 1

Kick-Off Session

7:00 PM – 9:00 PM EST (2 hours):

We’ll start with a comprehensive company overview, covering our core mission and values. Then, we’ll dive into the course agenda to give you a clear roadmap of what to expect. You’ll gain access to your company emails and our advanced tax software, setting you up for success. We’ll also discuss the details of your partnership with us and provide an overview of the potential earnings you can achieve.

Day 2

Class Session #1

10:00 AM – 6:00 PM EST (8 hours w/ breaks):

We’ll begin by covering the essentials of who pays taxes, giving you a strong foundation of general tax knowledge. Then, we’ll discuss bank products and how to ensure you get paid efficiently. You’ll learn the step-by-step process of filing taxes and when your clients can expect their refunds. We’ll also provide a detailed overview of our tax software program, the required documents for tax filing, and verification procedures. Lastly, we’ll identify the various tax forms and help you determine the appropriate taxpayer qualifications, whether single, married, or head of household.

Day 3

Class Session #2

10:00 AM – 6:00 PM EST (8 hours w/ breaks):

We will review the different types of tax forms and dive deeper into practicing how to input information into the tax software accurately. You will gain hands-on experience by working with 1040 forms, understanding what each column means, and practicing with W2 and 1095A forms. We’ll also cover the Due Diligence Checklist to ensure you follow IRS standards. Additionally, we’ll review who qualifies for Earned Income Credit (EIC) and other credits, including forms for dependents, child credits, and student loan credits. Homework will be provided to reinforce the material through practice during the week.

Day 4

Class Session #3

10:00 AM – 6:00 PM EST (8 hours w/ breaks):

We will begin by reviewing State Filing Forms, including how to determine residency for tax purposes. Then, you’ll practice working with 1099 Forms, understanding the necessary documents required for business taxes. We’ll delve into reviewing and practicing with Schedule C to ensure you accurately classify businesses and determine appropriate tax obligations. Homework will be provided to help you practice and solidify your knowledge throughout the week.

Day 5

Class Session #4

10:00 AM – 6:00 PM EST (8 hours w/ breaks):

We will review and practice with the 1098T Form, focusing on educational credits. We’ll then cover Schedule E Forms, which include depreciation and amortization. You’ll learn how to properly handle vehicle mileage and depreciation as well as practice with stocks and dividends (Div Forms). To wrap up, we’ll provide an overview of all forms covered throughout the course, ensuring you have a comprehensive understanding of the material.

What My Students Are Saying . . .

"I absolutely love Working with Lisbeth and the team. It's been a great experience and have learned so much to grow my business, knowledge and clientel. As a startup entrepreneur, things can be confusing and scary. But Lisbeth has made my experience very enjoyable. I am looking forward continuing to grow and keep learning from the best in the industry.."

— Ana, joined in 2023

Why This Course?

Let’s face it, you want to grow your business and your income, the easiest way to do that is by learning from someone who's been here before. The good news is that creating a profitable tax preparation business (or side gig) has never been faster or easier than it is right now with my Virtual 5-Day Tax Professionals Shortcut to Financial Freedom Course.

Let me show you how it works . . .

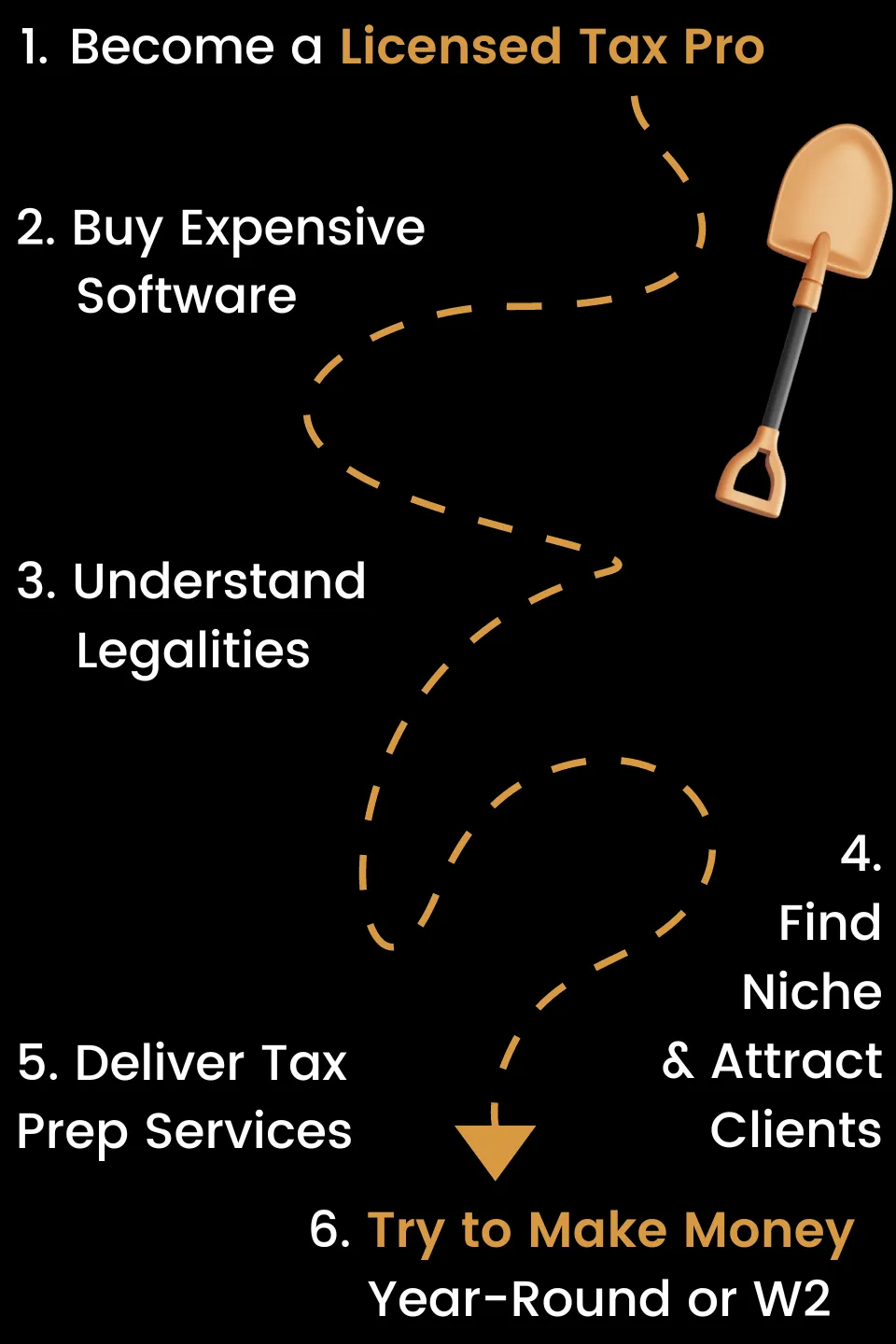

THE OLD WAY

THE NEW SIMPLE WAY

Most Tax Preparers Don't Make It On Their Own . . .

Getting started is EXPENSIVE

Tax software is costly, subscriptions range from $1,500 to over $20,000 per year. That's why you get my tax-compliant software included in this course.

The legalities are OVERWHELMING

Staying up-to-date doesn't have to be stressful. As your tax partner, I'll keep you updated on the information you and your clients need.

Finding new clients seems IMPOSSIBLE

My students average 30 new clients their first season. Learn how my marketing strategies can help you stand out, attract clients, and build your brand.

Tax season is short and UNSUSTAINABLE

Unless you want to scale your business and have employees, you should never have to ask, "How do I make money outside of tax season?"

Create a Successful Tax Prep Business in 5-Days working anywhere with wi-fi

Psst . . . it's timed perfectly for this upcoming tax season

Tax Knowledge and Skills

Fundamentals of individual, married, self-employment, and 1099 tax returns

Determining eligibility for dependents and Head of Household status

Differentiating services from competitors

Marketing and client acquisition strategies

Document collection and signature processes

Branded document templates

Profitability and pricing strategies

Business formation options (S-corp, B-corp, LLC) with pros and cons

Business Development

Access to a community of tax professionals

Free monthly training sessions

Partnership and mentorship program

Strategies for entering the Airbnb industry

Tax implications of first-time home buying

Empowering students to become independent entrepreneurs and refer new members

Software and Tools

Access to a customized IRS-compliant tax

software ($10,000 Value)

Software training and setup

Tax Knowledge and Skills

Fundamentals of individual, married, self-employment, and 1099 tax returns

Determining eligibility for dependents and Head of Household status

Differentiating services from competitors

Marketing and client acquisition strategies

Document collection and signature processes

Branded document templates

Profitability and pricing strategies

Business formation options (S-corp, B-corp, LLC) with pros and cons

Business Development

Access to a community of tax professionals

Free monthly training sessions

Partnership and mentorship program

Strategies for entering the Airbnb industry

Tax implications of first-time home buying

Empowering students to become independent entrepreneurs and refer new members

Software and Tools

Access to a customized IRS-compliant tax

software ($10,000 Value)

Software training and setup

Why This Opportunity?

Hi, I'm Lisbeth Recio . . .

I've walked in your shoes. Juggling a family, a career, and a side hustle or two . . . is no easy feat. I remember how overwhelming it was starting my own tax business. The endless hours of learning, the fear of making mistakes, the frustration of not knowing where to begin. It felt impossible. But I persisted because I saw the potential for financial freedom and flexibility it offered. Plus, how valuable it is to know how to do taxes for my other businesses. It’s a path that changed my life, and I want to make it easier for others.

Why This Opportunity?

Hi, I'm Lisbeth Recio . . .

I've walked in your shoes. Juggling a family, a career, and a side hustle or two . . . is no easy feat. I remember how overwhelming it was starting my own tax business. The endless hours of learning, the fear of making mistakes, the frustration of not knowing where to begin. It felt impossible. But I persisted because I saw the potential for financial freedom and flexibility it offered. Plus, how valuable it is to know how to do taxes for my other businesses. It’s a path that changed my life, and I want to make it easier for others.

Frequently Asked Questions

What States Is Your License Valid In?

Your IRS PTIN License is valid for All 50 States. In addition for filing for NY State taxpayers, an additional NYPTIN is required for this state.

Do I Need to Renew my License?

Yes, every year you must renew your PTIN and take at least 20 hours minimum of Federal and NY online courses to renew your license.

Are The Fees Tax Deductible?

All company fees and costs for the course is completely tax deductible and can be written off as business expenses.